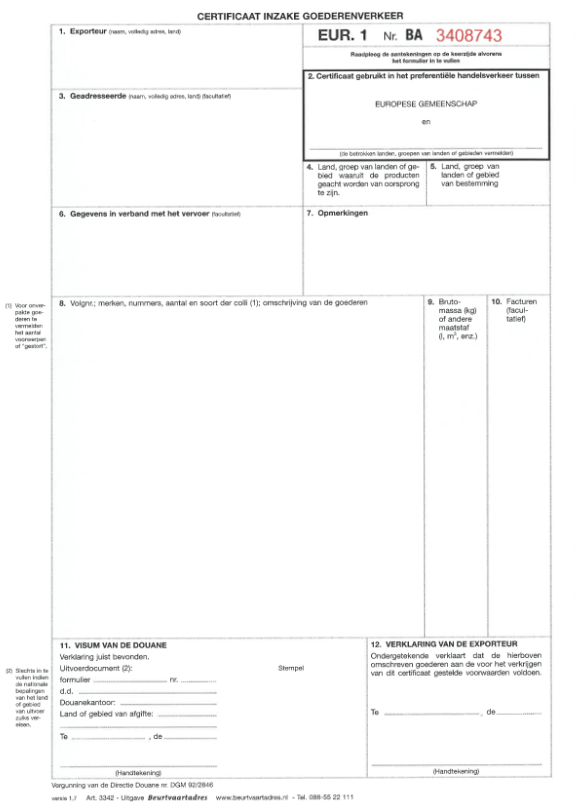

Reduce your import duties by filling out a EUR.1 document

Keeping the import duties as low as possible? Who doesn’t want that? It is, of course, more attractive to your customers to purchase your products if the costs remain low. The EUR.1 certificate, also referred to as EUR.1 document or EUR.1 movement certificate, can be used to ensure that import duties are reduced or sometimes even completely waived. But what is the meaning of EUR.1 and in which countries can you use it?

What is a EUR.1 certificate?

The amount you have to pay on import duties differs per country and product. To promote trade between countries or groups of countries, the European Union has concluded trade agreements. As a result of these trade agreements, the importer can make use of a preferential right to obtain a discount or exemption on the import duties. If you can demonstrate that the products have been produced in the EU, using the EUR.1 certificate, you qualify for a reduction of import duties.

The EUR.1 certificate is therefore a commercial document, validated by customs. This makes it cheaper for the importer. A condition to the reduction is that the goods must be of preferential origin from Europe. This means that the goods must come from Europe and that they must have a T2 customs status. You can prove this by means of a EUR.1 document. Products that are made in Europe, but have a T1 status, are not allowed to appear on a EUR.1 form.

An EUR-MED certificate is a variant of EUR.1. The EUR-MED is a certificate that can be used for trade between countries of the so-called Pan-European Mediterranean Cumulation.

In which countries are EUR.1 documents required?

For many countries outside the EU, a Certificate of Origin (COO) is required to import products. But which countries require EUR.1 documents? You can use a EUR.1 document or EUR-MED document for countries with which the European Union has trade agreements. There are countries with which preferential trade agreements have been in force for years, but new agreements are also added regularly.

In specific cases, you can also get a reduction or exemption from import duties without EUR.1 documents. You don’t have to use a EUR.1 certificate of origin when the value is less than €6,000. In that case, an invoice statement will suffice. There are also countries that never use the EUR.1 or EUR-MED, but instead an invoice declaration from the customs is needed. For example, if you want to export to South Korea, you need a License Approved Exporter and when exporting to Canada you must be a Registered Exporter (REX) if the value is over €6,000.

EUR.1 documents for the export to the UK and Switzerland

The United Kingdom left the EU on January 31, 2020. Does this affect the EUR.1 certificate when exporting to the UK? After the Brexit, it is no longer possible to apply for a EUR.1 certificate for goods from the UK because they can no longer be transferred as an ‘EU preferential good’. Since the UK is no longer a member of the EU, it is no longer part of the free trade agreements that the EU has concluded.

As is well known, Switzerland is not part of the EU despite being surrounded by countries that are. But how does it work with EUR.1 certificates if you want to export to Switzerland? Even though Switzerland isn’t part of the EU, they’ve got a trade agreement with the EU. Goods originating in the EU or Switzerland can therefore receive a reduction or exemption from import duties by using a EUR.1 certificate.

Advice: find out if import duties are levied on your products in Switzerland before handling the EUR.1 forms.

The difference between a EUR.1 document and a certificate of origin

We’ve already dropped it a few times, the goods must be produced in Europe. A certificate of origin proves that the goods meet the criteria to be considered of origin from a particular country. Note that this is not necessarily the country of export.

The EUR.1 certificate is a kind of Certificate of Origin. Using a EUR.1 certificate of origin is not mandatory, but if it is not used, import duties are entirely levied and you can’t benefit from preferential rates. You can also import and export goods without the EUR.1. Overall, the big difference between a EUR.1 and a Country of Origin (COO) is that a EUR.1 isn’t required, and a COO is.

How do you request a EUR.1 document?

There are two options to request a digital document:

- You arrange this online through an intermediary

- You engage a logistics service provider

If you are a trader, you can request a supplier’s declaration of preferential origin. You can also submit the purchase and sales invoice to the Chamber of Commerce.

When the Chamber of Commerce prepares the EUR.1 or EUR-MED, you will receive two copies. One copy for customs that makes the document valid, and one original document. The original will be sent with the shipment, including customs clearance. It often happens that the original papers get lost among all the papers during shipment. Therefore, you can also decide to send the papers by post instead of sending them along with the shipment. Finally, you can discuss with your logistics partners whether they can arrange the customs inspection or validation for you.